Jamie S. Fairey

I’m an Economics student at Royal Holloway, University of London, predicted a First Class. I’m interested in M&A, corporate finance, and investment research, and I enjoy using data and quantitative analysis to solve real problems. I’ve built financial models in Excel and run econometric analysis on macroeconomic trends, and I’m especially interested in how data-driven insights can shape valuation, market strategy, and portfolio performance.

Skills

Excel · Intermediate Financial Modelling · Econometrics · Data Analysis · Valuation · Corporate Finance · R · Market Research · Data Visualisation · Analytical Problem-Solving · Communication

Equity Research & Valuation Models

A selection of independently built valuation models combining financial analysis, market reasoning, and economic context.

All models and reports are created for demonstration purposes only and do not constitute investment advice or represent the views of any institution.

Project 1: Shell plc - Equity Research Model & Report

Built a five-year DCF valuation model (2025E–2029E) and accompanying analyst report estimating Shell’s intrinsic equity value under conservative energy price and cash-flow assumptions.

Focus: discounted cash flow modelling, valuation sensitivity analysis, and investment recommendation formulation.

View Model: Shell DCF Valuation (Excel)

Project 2: ASML Holding N.V. - Portfolio Alpha & Risk Attribution Model & Report

Built a five-year alpha attribution and regression model (2020–2025) analysing ASML’s systematic and idiosyncratic risk relative to the STOXX 600 Technology Index. The model quantifies performance drivers through beta (market exposure), alpha (abnormal return), and key portfolio efficiency metrics.

Focus: capital asset pricing (CAPM) regression, risk-adjusted performance attribution, and interpretation of Jensen’s alpha and beta.

View Model: ASML Portfolio Alpha & Risk Model (Excel)

Project 3: Siemens AG – Schneider Electric Merger Model & Deal Analysis Report

Developed a full merger valuation and accretion/dilution model (FY2025E–FY2029E) assessing Siemens AG’s proposed acquisition of Schneider Electric. The model integrates discounted cash flow (DCF) valuation, synergy realization scenarios, and EPS impact sensitivity to determine value creation potential and shareholder implications.

Focus: M&A valuation modelling, pro forma financial consolidation, synergy quantification, and scenario-driven accretion/dilution analysis.

View Model: Siemens–Schneider Merger Model (Excel)

Analytical Work Samples

A selection of University work combining data analysis, financial reasoning, and economic insight.

Assignment 1: Economic Growth & Development Analysis:

Used World Bank data and Excel to evaluate GDP per capita growth (2000–2015) across developed and developing economies.

Focus: CAGR calculations, chart-based data visualisation, and macroeconomic comparison.

Assignment 2: Regression-Based Institutional Analysis

Conducted regression analysis using OECD data to explore the relationship between inequality and obesity rates.

Focus: regression interpretation, statistical reasoning, and concise presentation of results.

View Extract: Econometric Study on Inequality & Obesity (PDF)

Projects

A selection of projects combining data analysis, financial reasoning, and economic insight.

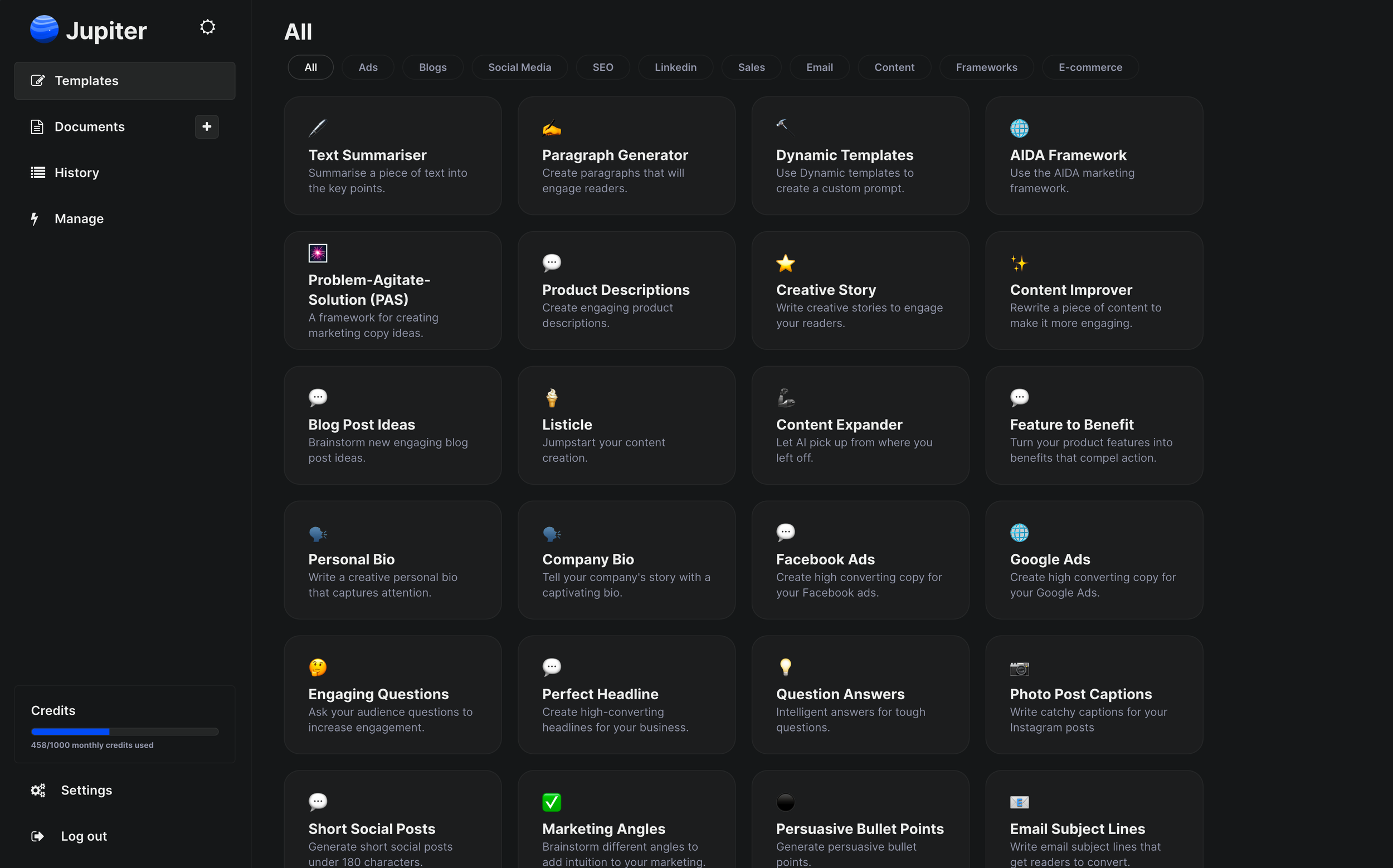

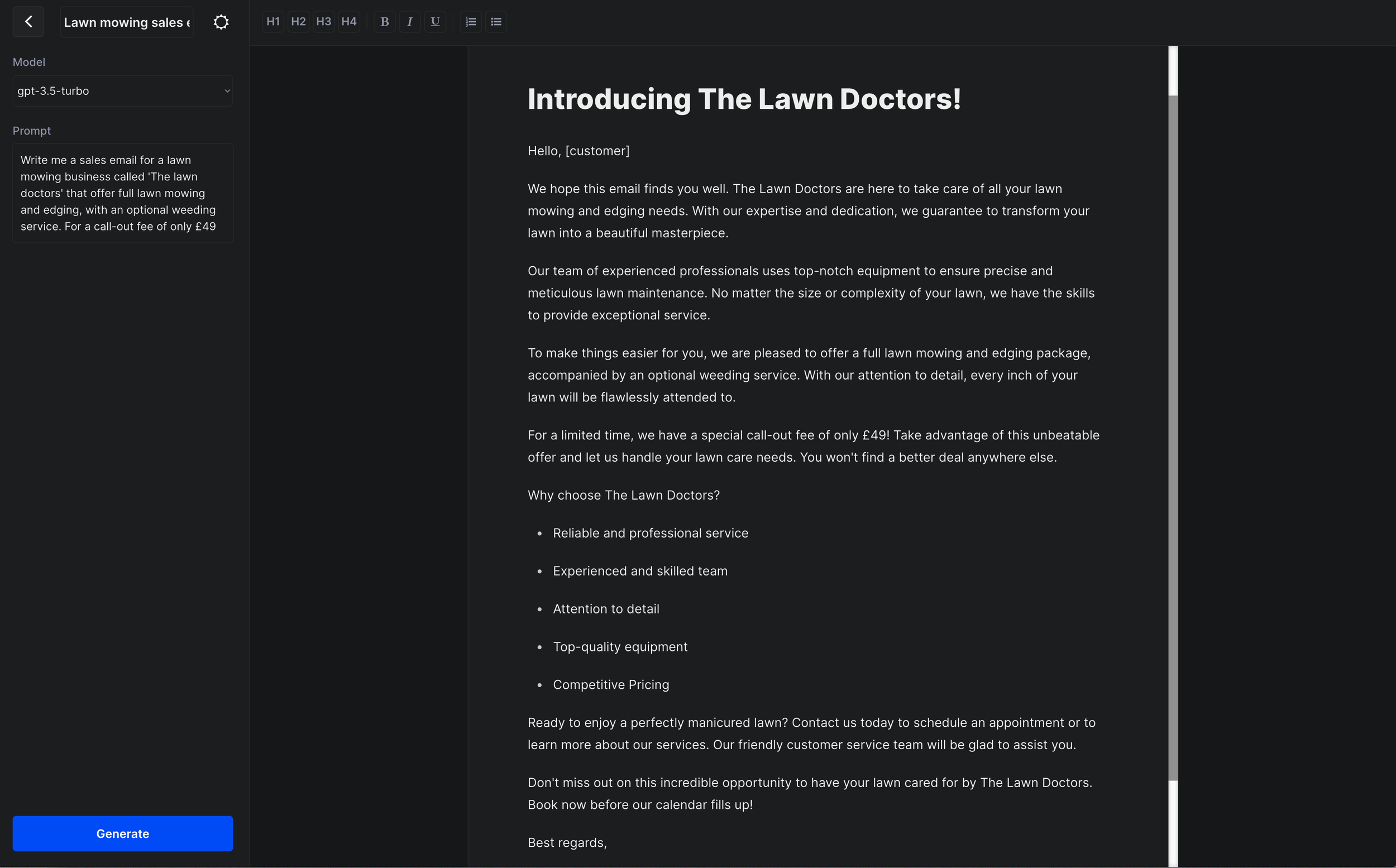

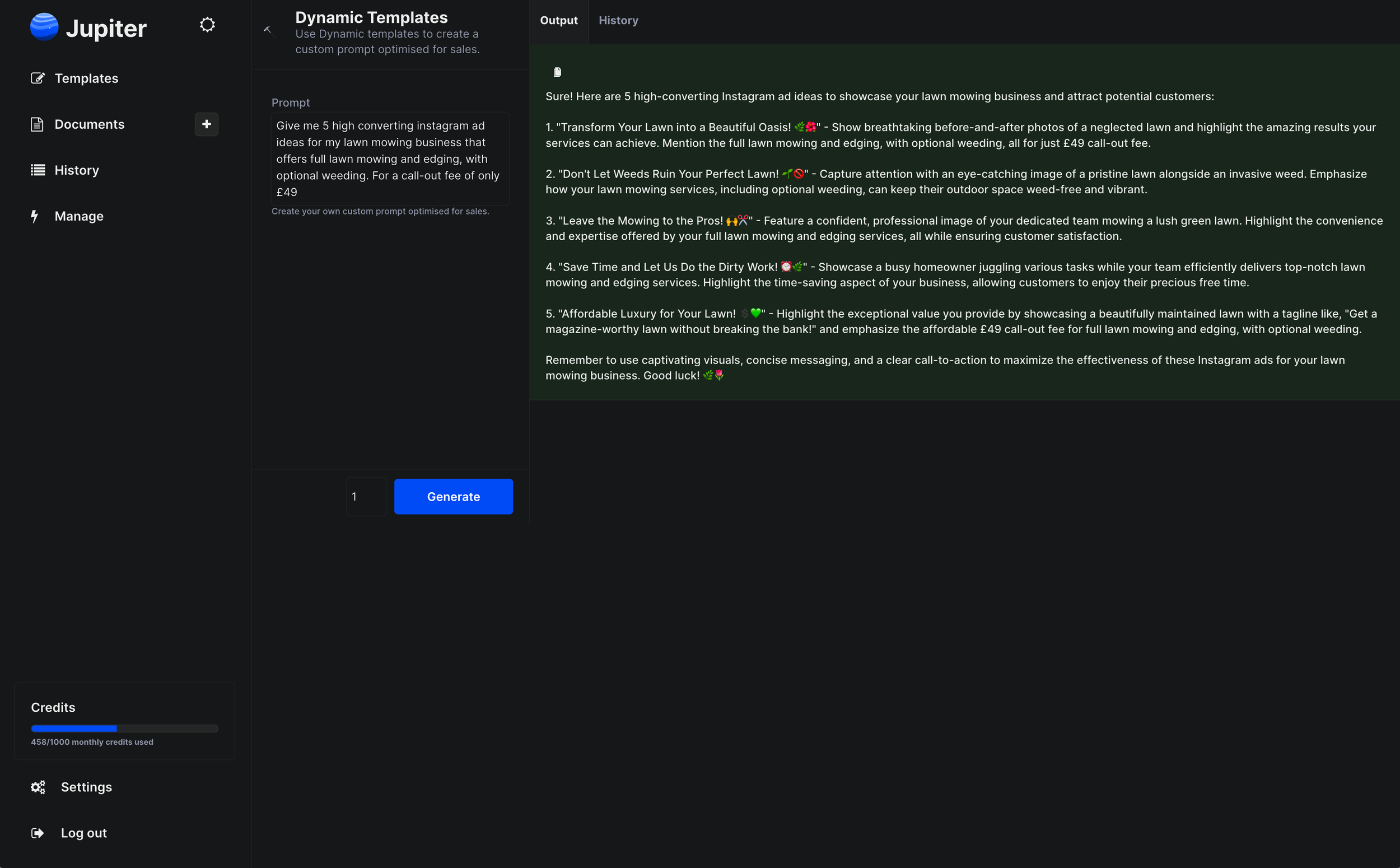

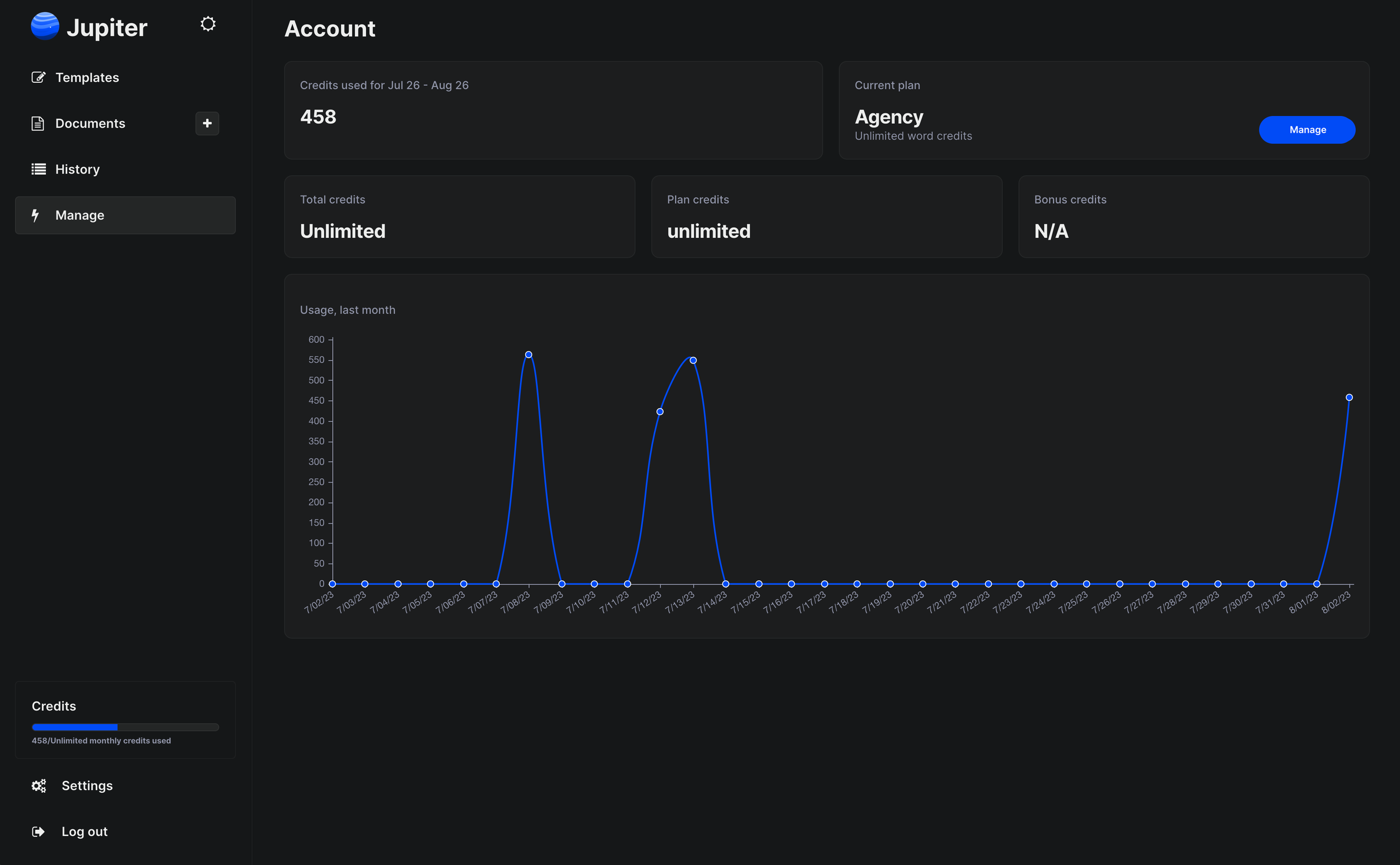

Project 1: Jupiter AI - Applied AI Productivity Platform (2023-2024)

Designed and built an AI-assisted writing and automation platform integrating prompt templates, content generation, and a document editor. Developed with a focus on improving research efficiency and communication workflows through adaptive natural language generation.

Focus: applied machine learning, product design, and workflow automation.

Dashboard Screenshots:

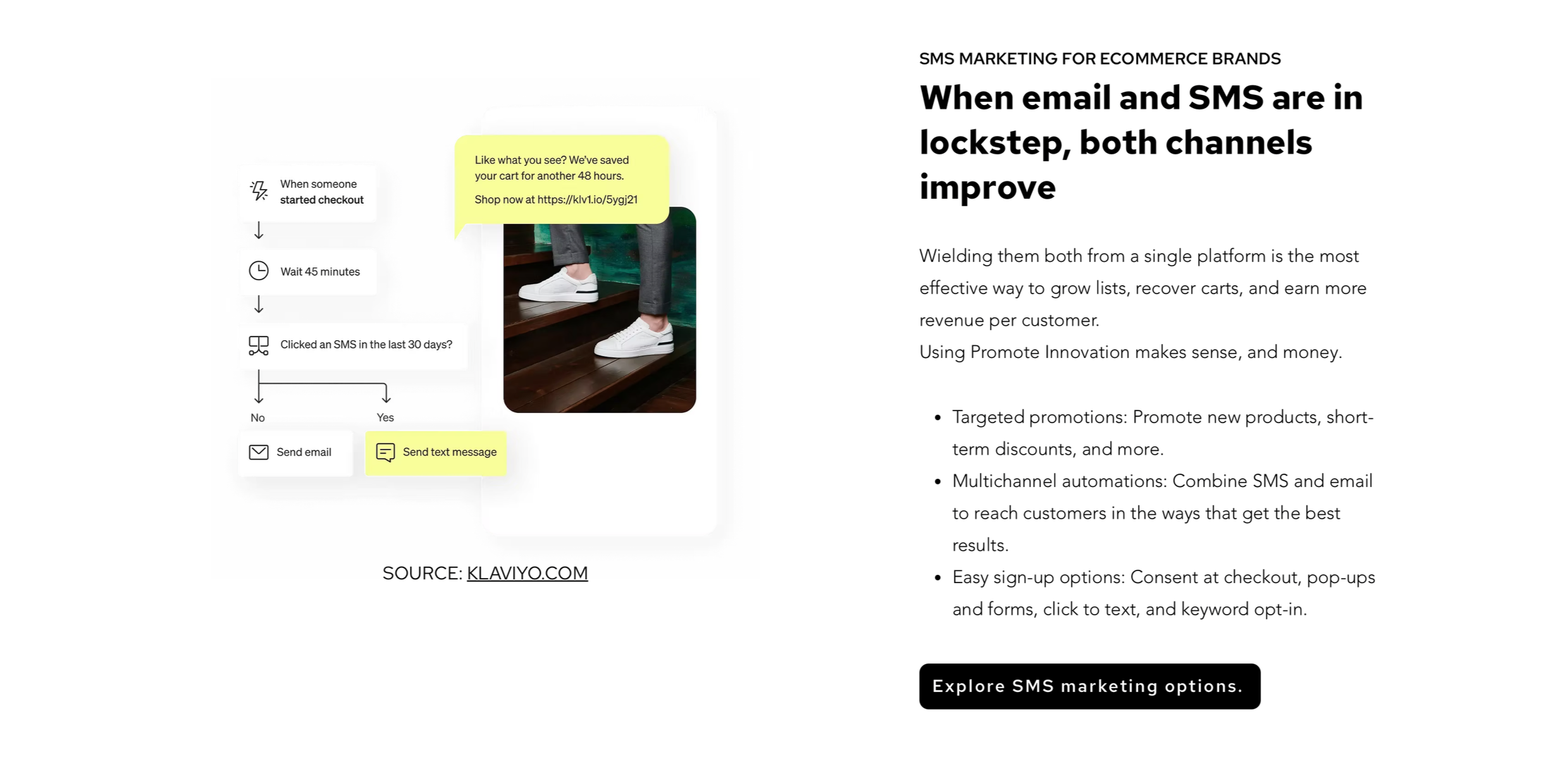

Project 2: Promote Innovation — Data-Driven Marketing Agency (2022-2024)

Founded an email marketing agency focused on performance-based automation for e-commerce and software clients. Designed retention-driven campaigns and implemented segmentation strategies that optimised customer lifetime value and conversion rates using data insights.

Focus: entrepreneurship, marketing analytics, and data-driven strategy.

Landing page Screenshots: